Here are the key documents of homeownership: If you have your documents ready, you’re already on your way to a smooth refinancing or selling experience. If you are selling the house before the whole debt is paid, then, in effect, the buyer is paying off the remaining debt. This is when the substitution of trustee is documented and reconveyance is given to a new lender.īefore you can refinance, the title company will ask you to order a payoff statement from the earlier lender. If you are one of these owners, you’ll need to make a final payoff on your current loan. Many owners are thinking now is the right time to refinance for the first or second time. Interest rates are still at historic lows. Reason for the Reconveyance Deed: Refinancing or Selling Be sure that the new deed precisely matches the earlier one. Īs a firm rule, whenever a new deed is made, the homeowner should check every line for accuracy.

The fix could be a simple correction deed. ☛ Found a typo in a deed? Is there a misspelling of a name or a mistake in the property’s legal description ? Don’t panic. If the deed of reconveyance isn’t properly recorded, the house title isn’t clear. Everything must be done according to the rules, so there’s no trouble later on when you transfer the title to a new owner. An accurate deed of reconveyance is a key component of proof of payoff and ownership. If you have received the deed of reconveyance to file, check it for any mistakes. In this case the owner receives a copy of the original trust deed, the deed of reconveyance, and a new title. In some states, the lender sends the document to the homeowner, who then has the deed of reconveyance notarized and filed with the recorder of deeds in the county where the property is located. Lenders must meet the deadline or pay penalties and costs.

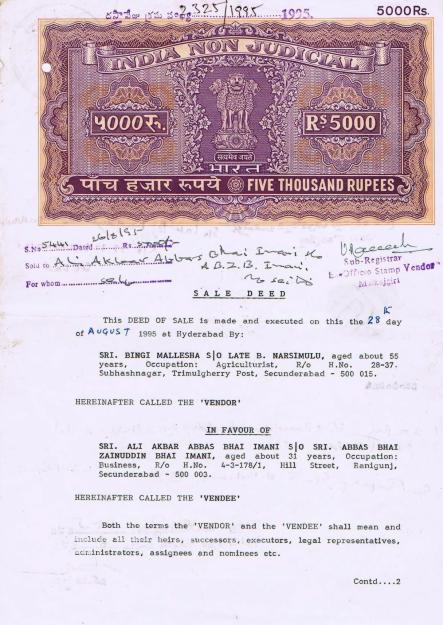

Lenders typically have the deed of reconveyance done within 30 or 60 days after payoff, following the state’s allowed window of time. Once you’ve repaid your loan in full - either because you’re done with the debt or you’re refinancing with another loan - your lender will have the deed of reconveyance created by the title company. This occurs when you are selling the home, or in a refinance situation, when you get a new loan in place of the old. States that use the deed of trust use this method to confirm that your loan has been paid in full. Alternatively called a mortgage satisfaction or a full reconveyance form (depending on your state’s legal custom), it’s your official proof of title transfer from the lender. If your mortgage exists in the form of a deed of trust, what happens at final payoff time? You’ll receive a deed of reconveyance, signed by the lender and notarized. Exiting a Mortgage in a “Deed of Trust State”

0 kommentar(er)

0 kommentar(er)